Investing in internationalmarkets can be an excellent way to diversify your portfolio and tap into growth opportunities that may not be available domestically. Internationalmarkets offer a range of potential benefits, from exposure to emerging economies to hedging against domestic economic downturns. However, investing internationally also comes with its own set of challenges and risks. Here, we will explore eight proven strategies for successfully navigating and investing in international markets.

1. Understand the Local Economy

Investing in internationalmarkets starts with a deep understanding of the local economy. This includes the economic growth rate, inflation, interest rates, and political stability.

- Economic Growth: Look for countries with strong economic growth indicators. These countries often provide better returns on investment.

- Inflation and Interest Rates: High inflation can erode returns, while high interest rates can indicate a healthy economy but also higher borrowing costs.

- Political Stability: Political turmoil can lead to market volatility. Ensure the country has a stable political environment.

By comprehensively understanding the local economic environment, you can make more informed decisions and mitigate risks associated with economic volatility.

2. Diversify Across Regions and Sectors

Diversification is crucial when investing in internationalmarkets. By spreading your investments across different regions and sectors, you can reduce the impact of localized economic downturns.

- Regional Diversification: Invest in multiple countries across various continents to mitigate region-specific risks.

- Sectoral Diversification: Allocate your investments across different sectors such as technology, healthcare, finance, and consumer goods. This strategy reduces the risk associated with sector-specific downturns.

Diversification helps in achieving a balanced portfolio and protects against market fluctuations.

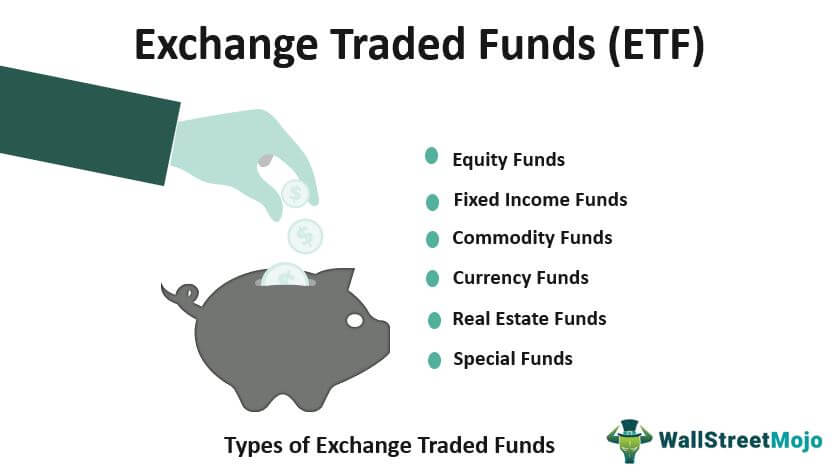

3. Utilize Exchange-Traded Funds (ETFs)

ETFs are an effective way to gain exposure to internationalmarkets without having to pick individual stocks. They offer diversification and are usually more cost-effective.

- Benefits of ETFs: They provide access to a broad range of securities within a single investment, reducing the risk of individual stock volatility.

- Choosing the Right ETFs: Look for ETFs that focus on specific regions, countries, or sectors that align with your investment goals.

ETFs simplify the process of international investing and offer a straightforward way to diversify your portfolio.

4. Conduct Thorough Market Research

Research is key to successful international investing. Understanding market dynamics, trends, and the competitive landscape is essential.

- Market Trends: Stay updated on the latest market trends and economic indicators in the countries you are investing in.

- Competitive Landscape: Analyze the major players in the market and their growth prospects.

Access to reliable data and research tools is critical for making informed investment decisions in internationalmarkets.

5. Consider Currency Risk

Currency risk is an inherent part of investing in internationalmarkets. Fluctuations in exchange rates can significantly impact your returns.

- Hedging Strategies: Use hedging strategies such as currency futures or options to mitigate the risk of adverse currency movements.

- Diversification: Diversifying investments across currencies can also help manage currency risk.

Being aware of currency risks and employing strategies to mitigate them can protect your investment from unexpected losses.

6. Evaluate Regulatory Environment

The regulatory environment in internationalmarkets can vary significantly from one country to another. Understanding these regulations is crucial to avoid legal pitfalls and ensure compliance.

- Regulatory Compliance: Ensure that your investments comply with local laws and regulations to avoid penalties.

- Investor Protections: Invest in countries with strong investor protection laws to safeguard your investments.

A favorable regulatory environment can enhance investment security and potential returns.

7. Leverage Technology and Online Platforms

Technology has made it easier than ever to invest in internationalmarkets. Online platforms and tools provide access to global markets, research, and trading capabilities.

- Online Trading Platforms: Use reputable online trading platforms that offer access to international markets and comprehensive research tools.

- Robo-Advisors: Consider using robo-advisors that specialize in international investments for automated, diversified portfolio management.

Leveraging technology can streamline the investment process and provide valuable insights into internationalmarkets.

8. Seek Professional Advice

Investing in internationalmarkets can be complex, and seeking professional advice can help navigate these complexities.

- Financial Advisors: Consult with financial advisors who specialize in international investments to develop a tailored investment strategy.

- Local Experts: Engage with local experts who have in-depth knowledge of the market and regulatory environment.

Professional advice can provide guidance on risk management, regulatory compliance, and identifying lucrative investment opportunities.

Conclusion

Investing in internationalmarkets presents a wealth of opportunities for diversification and growth. By understanding the local economy, diversifying across regions and sectors, utilizing ETFs, conducting thorough research, considering currency risk, evaluating the regulatory environment, leveraging technology, and seeking professional advice, you can navigate the complexities of international investing with confidence. For more insights on financial strategies, check out our article on What is the importance of financial knowledge?.

For more insights on foreign investment , check out Foreign Direct Investment .