The Tata Group, one of India’s largest and most diversified conglomerates, has recently witnessed significant rating upgrades for several of its firms by Standard & Poor’s (S&P). This development is not just a testament to the resilience and robust business practices of the Tata Group but also reflects the positive outlook on India’s corporate sector amidst global economic challenges.

Understanding the Significance of S&P’s Ratings

S&P Global Ratings is one of the most influential credit rating agencies in the world. Its assessments of corporate creditworthiness carry substantial weight in the financial markets, influencing investment decisions and the cost of capital for companies. When S&P upgrades a company’s rating, it typically signals improved creditworthiness, better financial stability, and a stronger ability to meet debt obligations.

The Tata Group: An Overview of India’s Industrial Giant

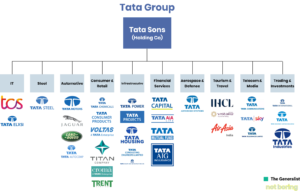

The Tata Group, founded in 1868 by Jamset ji Tata, has grown into a global conglomerate with interests spanning from steel and automotive to technology and telecommunications. The group is renowned for its commitment to ethical business practices, corporate governance, and social responsibility. With over 100 operating companies, the Tata Group has a significant impact on India’s economy and its global presence.

S&P’s Recent Upgrades: Which Tata Firms Benefited?

The recent upgrades by S&P have specifically highlighted the financial and operational strengths of several Tata Group companies. These upgrades are a reflection of the companies’ ability to maintain strong balance sheets, generate consistent cash flows, and effectively manage their debt levels.

Tata Steel: Strengthening the Backbone of Indian Industry

Tata Steel, one of the flagship companies of the Tata Group, has been a key beneficiary of S&P’s rating upgrade. The company has shown remarkable resilience in navigating through volatile global steel markets, thanks to its strategic acquisitions, efficient operations, and a diversified product portfolio. S&P’s upgrade acknowledges Tata Steel’s strong financial performance and its leadership in the steel industry.

Tata Motors: Driving Growth in the Automotive Sector

Tata Motors, another major entity within the Tata Group, has also seen an improvement in its ratings. The company’s turnaround strategy, which includes a focus on electric vehicles (EVs), innovation, and expansion into new markets, has positioned it as a key player in the global automotive industry. S&P’s rating upgrade reflects Tata Motors’ improved financial metrics and its potential for sustained growth.

Tata Consultancy Services (TCS): Leading the IT Revolution

Tata Consultancy Services (TCS), the IT arm of the Tata Group, continues to be a leader in the global technology services sector. TCS’s consistent revenue growth, strong client relationships, and robust operational efficiency have led to an upgrade in its ratings by S&P. This upgrade highlights TCS’s role in driving the digital transformation of businesses worldwide.

Tata Power: Energizing India’s Green Future

Tata Power, a pioneer in the energy sector, has been at the forefront of India’s transition to renewable energy. S&P’s upgrade of Tata Power’s ratings is a recognition of its strategic investments in solar and wind energy, its strong operational track record, and its commitment to sustainability. The rating reflects the company’s ability to capitalize on the growing demand for clean energy in India.

The Impact of S&P’s Upgrades on the Tata Group’s Market Position

The upgrades by S&P are likely to have a positive impact on the Tata Group’s market position. Higher credit ratings typically lead to lower borrowing costs, greater investor confidence, and an enhanced ability to raise capital. For the Tata Group, these upgrades could translate into more competitive financing options, better terms for debt issuance, and increased interest from global investors.

Investor Confidence and Market Response to the Upgrades

The financial markets closely monitor S&P’s ratings, and the recent upgrades for Tata Group companies have been positively received by investors. The upgrades signal a reduced risk of default and improved financial stability, making Tata Group firms more attractive investment opportunities. This increased investor confidence could lead to higher stock prices, improved market capitalization, and a stronger overall financial performance for the group.

Strategic Implications for the Tata Group’s Future Growth

The S&P upgrades come at a time when the Tata Group is strategically positioning itself for future growth. With investments in emerging sectors such as electric vehicles, renewable energy, and digital technology, the Tata Group is well-prepared to leverage its upgraded ratings to fuel expansion. The improved ratings could facilitate access to new markets, enhance partnerships, and support the group’s long-term vision.

Challenges and Opportunities Ahead for Tata Group Firms

While the S&P upgrades are a positive development, the Tata Group must continue to navigate several challenges, including global economic uncertainties, regulatory changes, and evolving consumer preferences. However, the group’s diversified portfolio, strong leadership, and commitment to innovation provide a solid foundation to capitalize on new opportunities and sustain its growth trajectory.

The Role of Corporate Governance in S&P’s Rating Upgrades

Corporate governance has been a cornerstone of the Tata Group’s success. S&P’s rating upgrades reflect not only the financial health of the group but also its adherence to high standards of corporate governance. The Tata Group’s emphasis on transparency, accountability, and ethical business practices has played a critical role in securing these upgrades and will continue to be a key factor in maintaining investor trust.

Global Recognition and the Tata Group’s International Presence

The S&P upgrades also underscore the global recognition of the Tata Group’s business acumen and its significant international presence. With operations in over 100 countries, the Tata Group’s ability to compete on a global scale is further validated by these rating upgrades. This international recognition enhances the group’s brand value and strengthens its position as a global corporate leader.

The Economic Impact of S&P’s Upgrades on the Indian Market

The upgrades of Tata Group firms by S&P are not just significant for the conglomerate but also for the broader Indian market. As one of the largest business groups in India, the Tata Group’s financial health has a ripple effect on the Indian economy. The improved ratings could boost investor confidence in the Indian corporate sector, attract foreign investment, and contribute to the overall economic growth of the country.

Conclusion: Tata Group Post-S&P Upgrades

The recent S&P rating upgrades represent a pivotal moment in the Tata Group’s long and illustrious history. These upgrades are not just a reflection of the group’s current financial health but also an endorsement of its strategic direction and operational excellence. As a conglomerate that has been an integral part of India’s industrial and economic fabric for over a century, the Tata Group has consistently demonstrated its ability to adapt and thrive amidst changing global and domestic landscapes.

Strengthening Financial Resilience

The S&P upgrades are a clear indication of the Tata Group’s robust financial resilience. In an era marked by economic uncertainties, supply chain disruptions, and geopolitical tensions, maintaining a strong financial position is crucial. The upgrades signal that the Tata Group has effectively managed its debt, optimized its capital structure, and ensured steady cash flows. This financial strength will be a cornerstone of the group’s ability to navigate future challenges, whether they stem from market volatility, regulatory changes, or shifts in consumer demand.

Leveraging Strategic Investments for Future Growth

The Tata Group has been strategically investing in sectors that are poised for exponential growth, such as electric vehicles (EVs), renewable energy, and digital technology. These sectors are not just the future of global industry but also critical to India’s economic development and sustainability goals. The S&P upgrades enhance the group’s ability to attract capital and forge partnerships in these high-growth areas. With improved access to financing, the Tata Group can accelerate its investments in innovation, research and development, and infrastructure, thereby securing its competitive edge in the global market.

Enhancing Global Competitiveness

The Tata Group’s global footprint is one of its most significant assets. Operating in over 100 countries, the group has established itself as a leader in multiple industries, from steel and automobiles to technology and consumer goods. The S&P upgrades reinforce the group’s reputation on the international stage, making it a more attractive partner for global businesses, investors, and governments. This enhanced competitiveness will allow the Tata Group to expand its market share in existing markets while exploring new opportunities in emerging economies.

Upholding Corporate Governance and Ethical Standards

One of the key factors behind the S&P upgrades is the Tata Group’s unwavering commitment to corporate governance and ethical business practices. In an age where corporate accountability and transparency are increasingly under scrutiny, the Tata Group’s adherence to these principles sets it apart from its peers. The group’s strong governance framework ensures that it not only meets regulatory requirements but also builds long-term trust with stakeholders, including investors, employees, customers, and communities. This trust is invaluable and will continue to underpin the group’s success in the years to come.

Contributing to India’s Economic Development

As one of India’s largest and most influential business groups, the Tata Group plays a vital role in the country’s economic development. The S&P upgrades are likely to have a positive ripple effect on the broader Indian economy, boosting investor confidence in Indian businesses and potentially attracting more foreign direct investment (FDI). The group’s success, as reflected in these upgrades, also highlights the growing strength and maturity of India’s corporate sector, which is increasingly being recognized on the global stage.

Navigating Future Challenges with Confidence

While the S&P upgrades are a significant achievement, they also set a high bar for the Tata Group to maintain its performance. The global business environment remains dynamic, with challenges such as technological disruption, climate change, and evolving consumer preferences on the horizon. However, the Tata Group’s strategic foresight, financial discipline, and commitment to sustainability position it well to tackle these challenges head-on. The group’s ability to innovate and adapt will be critical in ensuring that it not only meets but exceeds the expectations set by the recent ratings.

A Vision for the Future

Looking ahead, the Tata Group is poised to continue its journey of growth and transformation. The S&P upgrades serve as both a recognition of past achievements and a catalyst for future endeavors. As the group charts its course for the future, it will likely focus on expanding its presence in cutting-edge industries, deepening its commitment to sustainability, and further enhancing its global leadership. The Tata Group’s vision for the future is one that balances profitability with purpose, growth with responsibility, and innovation with integrity.

In conclusion, the S&P rating upgrades are more than just a financial milestone for the Tata Group; they are a validation of its strategic direction, operational excellence, and unwavering commitment to its core values. As the group embarks on the next chapter of its storied history, these upgrades will serve as a foundation upon which it can build even greater success, both in India and on the global stage. The Tata Group’s journey is a testament to the power of vision, resilience, and ethical leadership in shaping a brighter future for businesses and society at large.

For more information related to the S&P ratings upgrade of Tata Group firms:

1. S&P Global Ratings https://www.spglobal.com/ratings/en/

2. Tata Group https://www.tata.com/

These sources provide detailed insights into credit ratings, financial performance, and the overall strategic direction of Tata Group companies.

Check out! Parallel Pursuits: India’s 78th Independence Day and Quest for Financial Freedom – FINANCE WRITES