The stock market is a complex and ever-changing entity, influenced by a myriad of factors ranging from political events to economic shifts. Historically, the Lok Sabha election result days have been known to cause significant market turbulence. However, recent analyses suggest that the stock market could be on the brink of an even bigger crash than what was witnessed during these election result days. This article delves into the potential reasons behind this alarming forecast, the historical context of election impacts on the stock market, and what investors can do to mitigate risks.

Historical Context: Lok Sabha Election Result Day

Lok Sabha election results have always been pivotal for the Indian stock market. The outcomes influence political stability and shape economic policies, making investors highly sensitive to the results. Understanding past market reactions can provide valuable insights into current market dynamics.

Past Market Reactions

-

2004 Elections:

- Unexpected coalition formations led to market volatility.

- The market experienced a sharp decline as investors reacted to the political uncertainty.

-

2014 Elections:

- A decisive victory for the BJP resulted in a significant market surge.

- The market responded positively to the promise of stable governance and economic reforms.

-

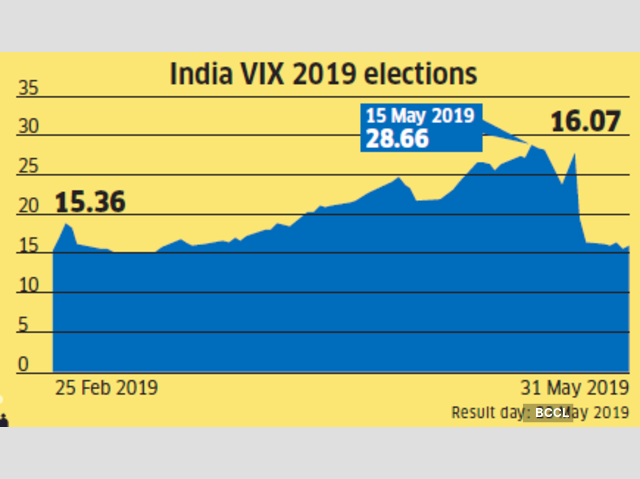

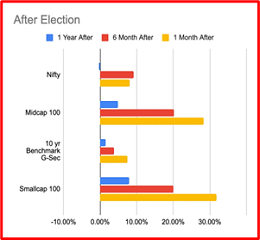

2019 Elections:

- The re-election of the BJP led to a mixed market reaction.

- While there was initial enthusiasm, market gains were tempered by underlying economic concerns.

Current Market Conditions

Several factors contribute to the current state of the stock market, making it particularly vulnerable to a significant crash. Understanding these factors is crucial for investors looking to navigate these turbulent times.

Global Economic Slowdown

The global economy is experiencing a slowdown, influenced by trade tensions, the aftermath of the COVID-19 pandemic, and geopolitical instability. These factors collectively contribute to a cautious market sentiment.

- Trade Tensions: Ongoing trade wars, particularly between the US and China, have created an uncertain global trade environment.

- COVID-19 Aftermath: The pandemic has left lasting impacts on global supply chains and economic activities.

- Geopolitical Instability: Conflicts and political unrest in various parts of the world add to the economic uncertainty.

Rising Inflation

Inflation rates have been climbing, impacting the cost of living and reducing disposable income. High inflation often leads to increased interest rates, which can negatively impact the stock market.

- Cost of Living: Rising prices of goods and services reduce consumer spending power.

- Interest Rates: Central banks may raise interest rates to combat inflation, leading to higher borrowing costs for businesses and consumers.

Corporate Earnings

Many companies have reported lower-than-expected earnings, leading to a decline in stock prices. This trend is expected to continue, contributing to market volatility.

- Earnings Reports: Disappointing earnings can lead to negative market sentiment and sell-offs.

- Sector Impact: Certain sectors, such as technology and retail, may be more affected by lower earnings.

Comparing Potential Crash to Lok Sabha Election Day

The potential stock market crash that experts warn about could be more severe than what was witnessed on previous Lok Sabha election result days. The magnitude of impact and underlying causes differentiate this potential crash from past election-driven market movements.

Magnitude of Impact

While election results impact stock market sentiment primarily due to political and policy-related uncertainties, the current factors influencing the market are more widespread and fundamental.

- Widespread Factors: Global economic slowdown, inflation, and corporate earnings affect multiple sectors and markets.

- Prolonged Impact: A crash driven by these fundamental issues could be deeper and more prolonged than a politically driven one.

Strategies for Investors

Given the potential for a significant stock market downturn, investors need to adopt strategies to safeguard their investments. Here are some key strategies to consider:

Diversification

Diversifying investments across different asset classes can help mitigate risks. This includes bonds, real estate, and commodities, alongside equities.

- Asset Allocation: A well-diversified portfolio can reduce the impact of a downturn in any single asset class.

- Sector Diversification: Investing in different sectors can help spread risk.

Focus on Quality Stocks

Investing in fundamentally strong companies with robust business models and healthy balance sheets can provide some cushion against market volatility.

- Fundamental Analysis: Focus on companies with strong financials and growth potential.

- Defensive Stocks: Consider investing in sectors that are less sensitive to economic cycles, such as utilities and consumer staples.

Stay Informed

Keeping abreast of global economic trends, corporate earnings reports, and monetary policies can help investors make informed decisions.

- Market Research: Regularly review stock market analysis and economic reports.

- Economic Indicators: Pay attention to key indicators such as GDP growth, unemployment rates, and inflation.

Risk Management

Implementing stop-loss orders and setting clear investment goals can help manage risks effectively.

- Stop-Loss Orders: Set predetermined sell prices to limit losses.

- Investment Goals: Define clear investment objectives and risk tolerance.

Conclusion

The stock market is on the brink of facing a potential crash that could be more significant than what was experienced on Lok Sabha election result days. Factors such as the global economic slowdown, rising inflation, and disappointing corporate earnings are all contributing to this potential downturn. For investors, the key lies in diversification, focusing on quality stocks, staying informed, and implementing robust risk management strategies. By adopting these measures, investors can better navigate the uncertain stock market conditions and protect their portfolios from significant losses. As always, staying vigilant and proactive in managing investments is crucial in times of economic uncertainty.

For more Information regarding this topic, you may visit

https://www.indiatoday.in/business/budget/story/union-budget-2024-stock-

You may also like

Franklin India Multi Cap Fund: Comprehensive Guide to a Balanced Investment Strategy

[…] Stock Market May Face Bigger Crash Than Lok Sabha Election Result Day: Shocking Analysis 2024 –… […]

[…] Stock Market May Face Bigger Crash Than Lok Sabha Election Result Day: Shocking Analysis 2024 […]

[…] Stock Market May Face Bigger Crash Than Lok Sabha Election Result Day: Shocking Analysis 2024 […]