Union Budget 2024: Finance Minister Nirmala Sitharaman presented her seventh consecutive Budget in Parliament today – Tuesday, July 23. The Union Budget 2024 highlights key employment schemes, tax structure revisions, and reductions in customs duty on essential items like cancer medicines and mobile phones. The Budget is an action plan for the Modi 3.0 government, outlining a roadmap towards India’s development in the next five years.

Prime Minister Narendra Modi praised the Union Budget, stating it will benefit all sections of society and lay the foundation for a developed India.

Union Budget 2024: FM Sitharaman announces 3 schemes for employment linked incentives

- First timers: One month wage to new entrants in all formal sectors.

- Job creation in manufacturing: Incentives for employees and employers following EPFO guidelines.

- Support to employees: Additional employment incentives for 50 lakh people in all sectors.

Union Budget 2024: FM Sitharaman approves Rs 1.52 trillion for agriculture and allied sectors – In the next two years, one crore farmers will be initiated into natural farming.

Union Budget 2024: FM Sitharaman announces financial aid to Bihar

“We will support the development of an industrial node at Gaya in Bihar,” said Sitharaman. This initiative aims to catalyze the development of the eastern region with projects like the Patna-Purnea expressway, Buxar-Bhagalpur highway, Bodhgaya-Rajgir-Vaishali-Darbhanga road, and a new bridge over the Ganga in Buxar, totaling Rs 26,000 crores.

Union Budget 2024: FM Sitharaman’s statement on Andhra Pradesh

Recognizing the state’s need for capital, the government will facilitate special financial support through multilateral agencies, with Rs 15,000 crore allocated for the current fiscal year and additional amounts in future years.

Hostels for working women and internship opportunities

- Working women hostels: To promote higher participation of women in the workforce.

- Internships: Scheme to provide internships to 1 crore youth in top 500 companies with an allowance of Rs 5000 per month and a one-time assistance of Rs 6000.

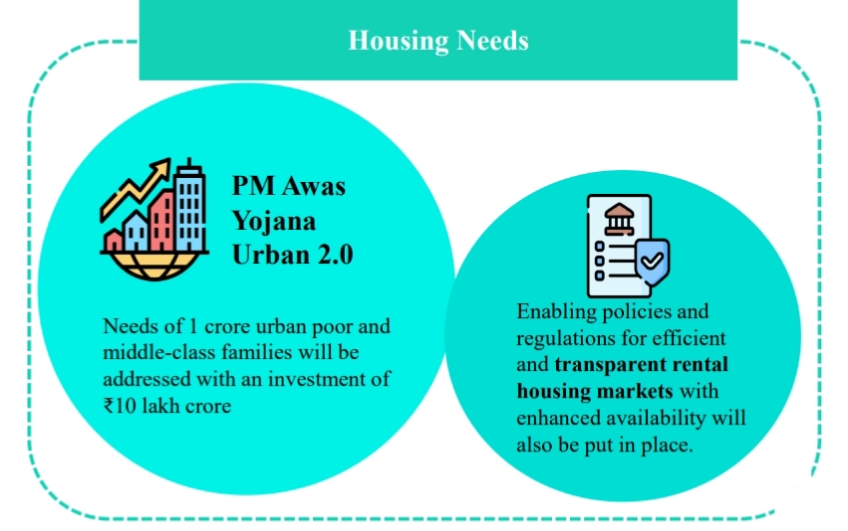

Union Budget 2024: Rs 2.2 trillion push for affordable urban housing

Housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of Rs 10 trillion.

Union Budget 2024: Mudra loans limit increased

The Mudra loan limit has been enhanced to Rs 20 lakh from Rs 10 lakh for those who have previously availed and repaid their loans.

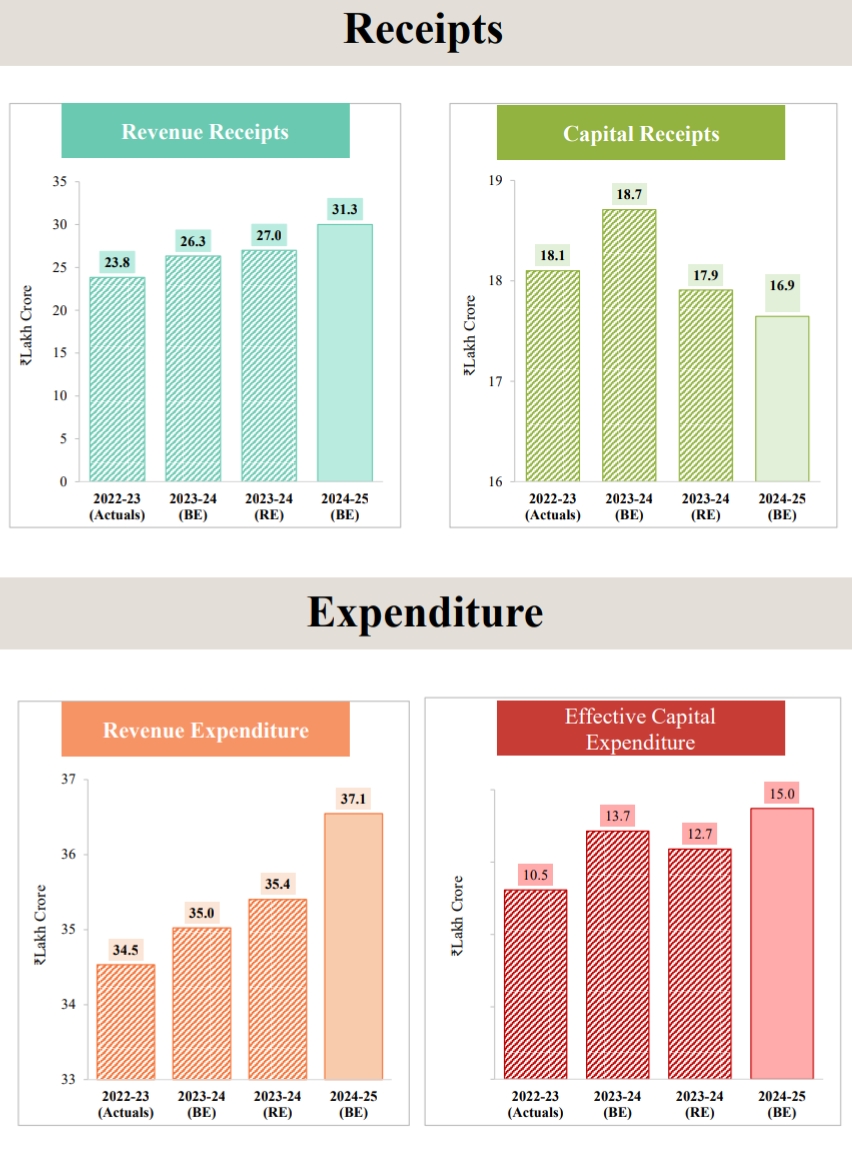

Union Budget 2024: Govt to spend Rs 11.11 trillion for capex in FY25

The government will provide Rs 11.11 trillion towards infrastructure spending and facilitate investment-grade energy audits of micro and small industries in 60 clusters.

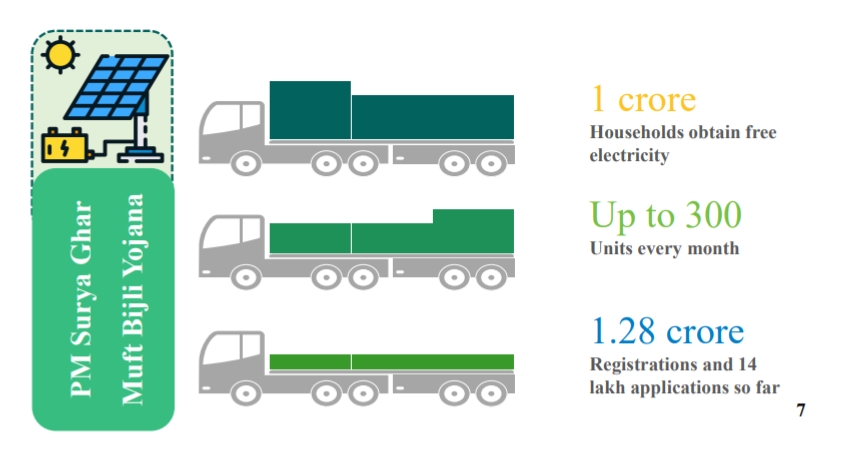

Union Budget 2024: PM Suryaghar Muft Bijli Yojana launched

This scheme aims to install rooftop solar panels to enable 1 crore households to obtain free electricity up to 300 units each month.

Union Budget 2024: Development of temples in Gaya and tourism in Odisha

The government will support the development of corridors at Vishnupad Temple and Mahabodhi Temple, as well as tourism projects in Nalanda, Bihar, and Odisha.

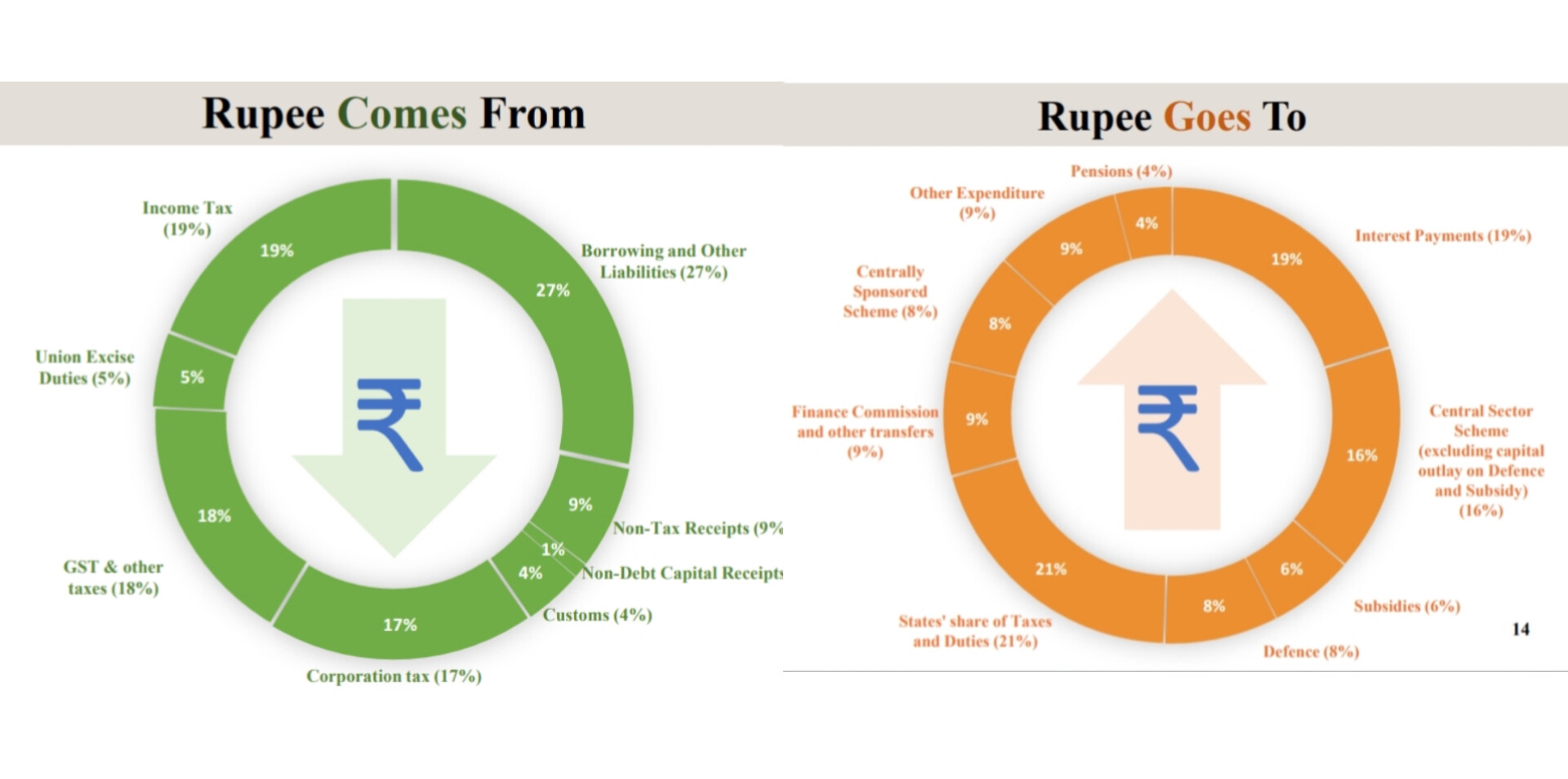

Union Budget 2024: Total receipts and expenditure

Total receipts are estimated at Rs 32.07 trillion, with an expenditure of Rs 48.21 trillion for FY25. Net tax receipts are projected at Rs 25.83 trillion.

Union Budget 2024: Changes to capital gains tax regime

The tax on long-term capital gains has been increased from 10% to 12.5%. Short-term capital gains will attract a 20% tax.

Union Budget 2024: Details of revised tax slabs

- Income up to Rs 3 lakh: No tax

- Rs 3-7 lakh: 5%

- Rs 7-10 lakh: 10%

- Rs 10-12 lakh: 15%

- Rs 12-15 lakh: 20%

- Income above Rs 15 lakh: 30%

The standard deduction for salaried employees has been increased from Rs 50,000 to Rs 75,000.

Union Budget 2024: Major announcements under PM’s package

- Loans up to Rs 7.5 lakh with a guarantee from a government-promoted Fund.

- Financial support for loans up to Rs 10 lakh for higher education in domestic institutions.

- Direct E-vouchers for 1 lakh students annually.

- Annual interest subvention of 3%.

Union Budget 2024: Changes in customs duty

- Duty cuts on mobile phones, PCBA, and mobile chargers to 15% from 20%.

- Reduction in customs duty on gold and silver to 6% from 15%.

Union Budget 2024: Enabling VCC structures like Singapore and Mauritius

India will enable pooled private equity fund structures as variable capital companies to attract more capital from overseas investors.

Union Budget 2024: Allocation for Defence

Allocated Rs 6.2 trillion, constituting 12.9% of the total Budget. The capital outlay of Rs 1.72 trillion will bolster the Armed Forces’ capabilities, with Rs 1.05 trillion earmarked for domestic capital procurement to support Atmanirbhar Bharat.

Conclusion

The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, is a comprehensive plan focusing on economic growth, employment, and infrastructure development. With significant allocations for various sectors and new schemes to boost employment and support for women and youth, the Budget aims to lay a strong foundation for a developed India.

For further details on the Union Budget 2024, you can visit Government of India Budget 2024.

Read My Other Articles :

Liked it.

[…] Union Budget 2024 Breakthrough: Transformative Policies for India’s Future […]

[…] Union Budget 2024 Breakthrough: Transformative Policies for India’s Future […]